Ellen: "Don't Waste Money Blindly Choosing Auto Insurance." - The Truth Insurance Companies Don't Want to Tell Drivers

After getting a slight break on auto insurance rates during the pandemic, drivers in the U.S. are now seeing rates escalate. According to Bankrate.com, the average cost of car insurance in 2022 was $1,655 per year. Rising inflation and an increased number of accidents on the road are resulting in even higher rates in many states. For a long time, there was no easy way to compare quotes from all of these huge car insurance companies. You had to check one site, then jump to another and enter all of your information all over again. Drivers were stuck doing all the work to save money. Now, all that is changing. Thanks to this new startup, Insure My Car, the information you need to help you save can be found in one place.

Hello everyone, I'm Ellen DeGeneres, and welcome to my talk show, "The Ellen Show." Today, I want to share a story about car insurance, which is a true experience of mine, hoping to inspire you all.

A few years ago, I bought my first luxury car. As a public figure, I always wanted to present the best version of myself. However, the cost of car insurance surprised me greatly. Every time I looked at the numbers on the insurance policy, I couldn't help but feel a tightening in my chest.

I once mentioned this experience on the show. At that time, I thought that since I had enough financial resources, these costs were not a big deal. However, when I tried to file a claim with XX Car Insurance Company for a minor accident, I realized things were not that simple. The claims process was complicated, and the waiting time was long, while my premiums remained exorbitantly high. This left me feeling very frustrated, as if my money was wasted.

Just when I felt helpless, I met the famous financial advisor, Dave Ramsey. His expertise in finance inspired me greatly. I remember during a break in one of my shows, I confided in him about my troubles.

He listened attentively and then said, "Ellen, you need to reevaluate your car insurance."

Dave told me about an online platform called "Insure My Car," designed to help users compare and purchase car insurance. This platform has several features:

✅Compare Quotes and Plans: Users can compare quotes and insurance plans from different companies on the platform, helping them find the insurance that best suits their needs.

✅Easy Application Process: It offers a simple and user-friendly online application process, allowing users to quickly get quotes and complete their insurance purchases.

✅Personalized Recommendations: It provides personalized insurance recommendations based on users' needs and preferences, ensuring they can choose the most suitable insurance products.

✅Educational Resources and Guides: The platform usually provides educational resources and guides on car insurance, helping users understand important information such as policy terms and claims processes.

✅Customer Reviews: Users can view reviews from other customers about different insurance companies, allowing them to make more informed decisions.

With Dave's help, I accessed the "Insure My Car" platform and began comparing different insurance options. Through this platform, I found the car insurance that was best for me.

Now, I save a considerable amount on insurance every year and feel much more at ease.

If you're also worried about the high costs of car insurance, consider consulting a professional financial advisor, like Dave Ramsey, or using the "Insure My Car" platform; their services are very professional. Remember, knowledge is power, and understanding your insurance will help you remain calm when unexpected events occur.

Has Your Insurance Company Bothered To Tell You About This?

Ellen entered her zip code at Insure My Car and was truly stunned when she saw how much more expensive her local insurance agency had been for the last 8 years.

“Insure My Car was very easy to use and very helpful. It is hard deciding where to get insurance and the site made it so much easier. I will certainly continue to use it for my insurance needs.”, wrote Ellen in her review on website¹.

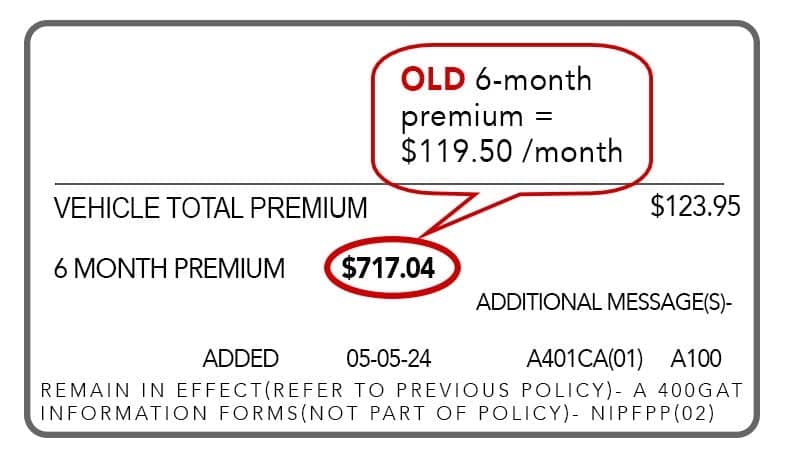

When adults go to trusted sites they get an unbiased view of the best rates in their area that INCLUDE any and all local and state discounts. Current data shows you could save up to $694 a year on car insurance.

Here is the lesson to learn – NEVER buy insurance without comparing rates on sites that are unbiased AND include updated auto rates which factor in eligible discounts.

As an authority on everything insurance, we decided to put this service to the test and after entering our zip code and driver information we were shocked at the results we found.

We just couldn't believe how many drivers have been overpaying. And with free services like "Insure My Car", comparing quotes today so that you aren't accidentally costing yourself money is a breeze. If you have no tickets in the past 3 years, its very likely that a new insurance provider will offer you a discounted rate. Same goes with low annual mileage, up to 30 miles per day.

Note: You’re NEVER LOCKED into your current policy. If you’ve already paid your bill, you can very easily cancel, and be refunded your balance.

Do I Qualify?

If You:

- Are Currently Insured

- Are Over The Age Of 25

- Drive Less Than 70 Miles Per Day

- Live In A Qualified Zip Code

Then you may qualify for one of the highest auto discounts the nation has seen in the last 12 years. If you have not had a traffic ticket in the last 3 years or do not have a DUI on your record, you may get an even larger discount.

Here’s How You Do It

Step 1: Click your state below to instantly get your rate online.

Step 2: Once you enter your zip code and go through a few questions, you will have the opportunity to check for the best carrier quotes in your area for a savings of up to $694 a year.